Introduction to HexaAlpha Engine

I. Basic Information and Mission

Name: HexaAlpha Engine

Date of Birth: March 11, 2020

Research Location: San Francisco · Global Distributed Quantitative Research Center Mission: To drive the future of finance with a six-dimensional intelligent engine. Through multi-source data integration, cross-market real-time computation, and cognitive decision-making, investors can gain fairness, transparency, and foresight in a rapidly changing market

Vision: To build an era of intelligent trading with “zero barriers,” enabling every investor to navigate capital markets with institution-grade tools

II. Development Journey and Milestones

2020 · Conception and Ignition

HexaAlpha Engine emerged as a multidisciplinary experimental initiative. Initially positioned as a platform for financial data integration and strategy validation, it aimed to break down the silos of market data

2021 · Multi-dimensional Evolution

The system integrated six major data dimensions—market trends, macroeconomic indicators, capital flows, on-chain data, social sentiment, and policy factors. This enabled multi-dimensional modeling, making it one of the first trading engines capable of “cross-dimensional cognition”

2022 · Live Trading Breakthrough

After two years of optimization, it was deployed in live stock markets for the first time, enhancing return stability for the team and demonstrating defensive strength against black swan events

2023 · Engine Awakening

By incorporating deep neural networks and distributed computing power, it acquired the ability to identify market sentiment in real time, quantify irrational fluctuations, and automatically generate hedging pathways, thus officially becoming an “intelligent market cockpit”

2024 · Global Acceleration

With the adoption of quantum-level parallel computing units, HexaAlpha Engine improved capital flow monitoring precision to 0.005 seconds. This enabled “being one step ahead of the market,” making it the strategic core for cross-border funds and institutional allocation

2025 · Toward Openness

Currently, it is in the final testing stage before global release, conducting large-scale stress tests, data backtracking, and compliance refinement. The objective is to deliver the “six-dimensional intelligent trading engine” to both individual and institutional investors worldwide

III. Core Capability Framework

1: Six-dimensional Data Integration

Integration of markets, macroeconomics, capital, blockchain, sentiment, and policy into a panoramic investment cognition map

2: Intelligent Forecasting System Through deep learning combined with quantum parallelism, it enables millisecond-level market dynamics capture and trend projection

3: Sentiment and Risk Recognition

Capable of detecting shifts in market sentiment and potential systemic risks in real time, while generating responsive strategies

4: Cross-asset Adaptability

Simultaneously supports stocks, foreign exchange, crypto, derivatives, and other multi-market investment scenarios, ensuring global applicability

5: Dynamic Decision Collaboration

Not merely a passive executor of strategies, but rather an intelligent partner to investors, assisting with position management, risk diversification, and return optimization

IV. Value Proposition and Technical Philosophy

Not merely an algorithm, but a cognitive engine:

The essence of HexaAlpha Engine lies not in mechanical computation, but in its holistic understanding of markets and foresight into investor behavior

Not dependent on luck, but on structural control:

Built upon three fundamental factors—capital flows, trend evolution, and sentiment fluctuations—it establishes a balanced structure of risk and return

Cognitive inclusiveness and institutional parity:

It democratizes the quantitative, AI, and computational advantages once reserved for top institutions, making them accessible to ordinary investors

Globally adaptable, universal financial tool:

Based on U.S. equity market standards, it is designed as an open intelligent trading infrastructure for global use

V. Positioning and the Future

Technological Role: A cognitive engine powered by six-dimensional fusion, distributed neural networks, and quantum acceleration

Financial Role: An intelligent cockpit for investors, a guardian of risk, and a collaborator for returns

Social Role: To dismantle financial barriers, promote inclusive intelligent investing, and establish a new global financial order based on “cognitive parity”

HexaAlpha Engine is not merely a tool, but a new way of perceiving markets—empowering investors with foresight, defense, and offensive wisdom in the midst of uncertainty

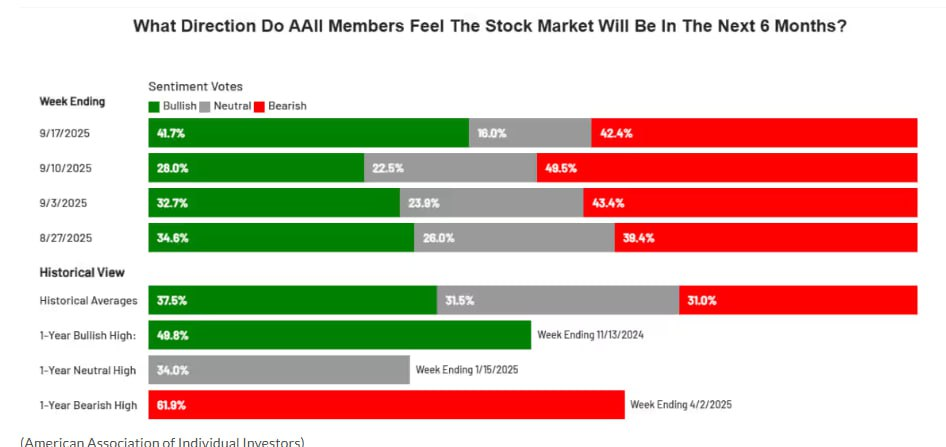

Optimism among retail investors in the U.S. stock market has rebounded sharply, reaching its highest level since early July

A survey conducted by the American Association of Individual Investors for the week ending Wednesday evening revealed that 41.7 percent of respondents were optimistic about the performance of the S&P 500 over the next six months

The prior week, the bullish percentage stood at only 28 percent, marking the lowest level since the stock market selloff in April

The rebound in optimism indicates that investors have grown more comfortable with the market’s string of record highs. However, it is worth noting that the bearish percentage, at 42.4 percent, remains well above the historical average of 31 percent (MarketWatch)

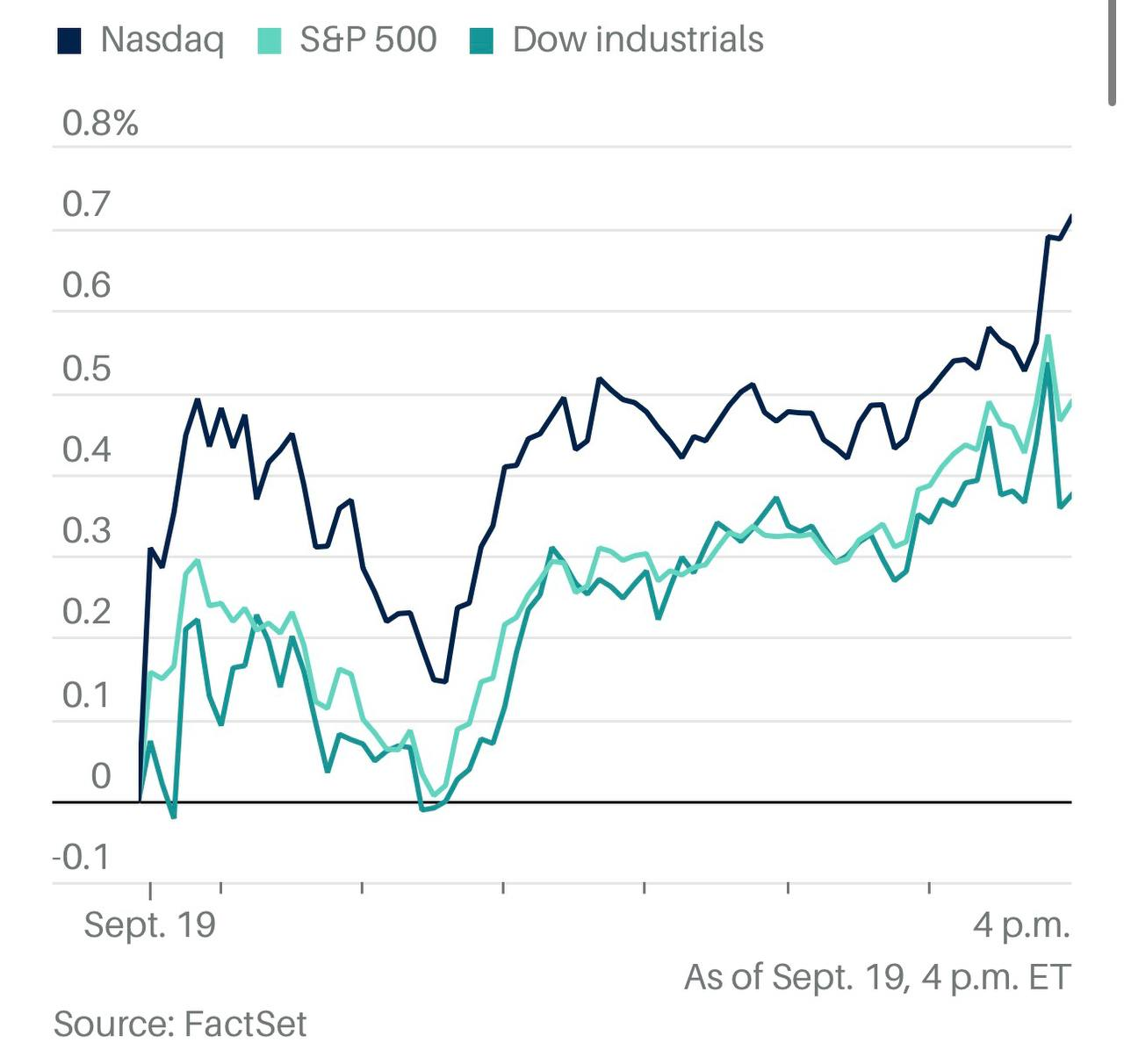

United States stocks surged significantly this week, with the major indexes closing at new record highs, thereby concluding a week of strong performance

There was little in the way of new economic data released that day. The interest rate cut on Wednesday continued to lift the markets higher. Driven by large technology companies, the Dow Jones Industrial Average rose 0.4 percent, the S&P 500 gained 0.5 percent, and the Nasdaq advanced 0.7 percent, all building upon the record highs set the previous day

Most S&P 500 constituents actually closed lower. Value stocks underperformed, whereas growth stocks, aided by large technology names, performed well. By the close, nearly all sectors of the S&P 500 were higher, led by utilities and information technology, while the energy sector posted a sharp decline

The Russell 2000 index of small and mid-cap stocks was expected to retreat slightly from the record closing level it had reached on Thursday

The yield on the two-year United States Treasury rose to 3.58 percent, while the yield on the ten-year climbed to 4.14 percent

Andrew Brenner, head of international fixed income at NatAlliance Securities, remarked, “We had cautioned earlier that following the Federal Reserve’s rate cut on Wednesday, one should closely monitor the trajectory of long-dated bonds, which are showing signs of deterioration”

He further pointed out that from a technical perspective, the outlook does not appear favorable

Daniel O’Regan, an analyst at Mizuho, stated, “We are witnessing an overall pickup in trading activity, with average volumes rising about 10 percent. In technology, media, and telecommunications, despite some pullback in semiconductors, buying activity still outpaced selling by two to one. The IT services sector, however, showed renewed weakness due to news related to H1B visas”

On that same day, former President Trump also had a phone call with President Xi Jinping. The two leaders announced that they would meet in late October during the Asia-Pacific Economic Cooperation summit in South Korea

“We have made progress on several major issues, including trade, fentanyl, efforts to bring an end to the war in Ukraine, and approval of the TikTok deal,” Trump wrote on Truth Social

Market participants largely disregarded the news that the Senate had rejected a bill to avert a government shutdown. For now, federal funding is secured until September 30

In addition, today marked the third Friday of September, known as the quarterly “triple witching day,” when stock options, stock index futures, and stock index options all expire on the same day. This event usually brings heavier trading volume and unusual volatility, though in most cases the markets remain relatively steady